Understanding Market Cycles: Why Human Behaviour Shapes Everything

When you understand the rhythm, the noise stops controlling you.

We still live in a world where markets - for all their algorithms, automation, and fancy dashboards - are ultimately human-driven.

People make decisions in real time about what to buy and when, what to sell and when. And those decisions, across millions of participants, create patterns not just in the short term, but over years.

These patterns are not random.

They repeat.

They form cycles.

Most People Don’t See Cycles - They Only See Prices

Most people react to what the prices are in the moment.

A coin went up yesterday → buy.

A stock fell today → panic sell.

A sector ran for the last three weeks → “I should get in.”

At best, the average person has one or two reference points:

“It was 80 last month, now it’s 95.”

“It crashed from 120 to 90.”

“It’s at all-time highs, it might go higher.”

And based purely on these narrow windows, they make decisions - usually to buy, because retail FOMO overwhelmingly works in one direction: chasing whatever is already going up.

But to understand cycles, you need to do something most people never do:

Zoom out.

And not weeks or months.

Years.

What Is a Market Cycle?

A market cycle is simply the collective behaviour of an entire asset class over a long period of time.

Different asset classes have different cycle lengths:

Equities (in many countries including India): ~7-year cycles

Real estate, commodities, bonds: their own long-term rhythms

Bitcoin / Crypto: ~4-year cycles for over a decade

Bitcoin is unique because it dominates its own asset class; its price movement effectively represents the entire crypto market

A cycle is not the story of one stock, or one token, or one NFT collection.

It’s the story of the entire market for that asset class.

Important Clarification #1: Cycles Apply to Asset Classes, Not Individual Units

Most people confuse this.

Cycles reflect broad human engagement with a category - equities as a whole, real estate as a whole, crypto as a whole.

Individual components of an asset class can die, disappear, underperform, or vanish entirely.

A stock can go to zero.

A token can never recover.

An NFT collection can surge once and collapse forever.

That does not violate the idea of cycles.

Those items didn’t form the cycle;

the asset class did.

Important Clarification #2: Not Every “New” Asset Class Gets Multiple Cycles

People often assume every new shiny thing will behave like equities or Bitcoin:

Boom → Bust → Boom again.

But cycles require:

sustained engagement,

sustained belief,

sustained inflows,

sustained economic value.

If an asset class has one boom, then collapses and never recovers - like most NFT collections - then it never formed a multi-cycle pattern to begin with.

Cycles belong to assets that endure.

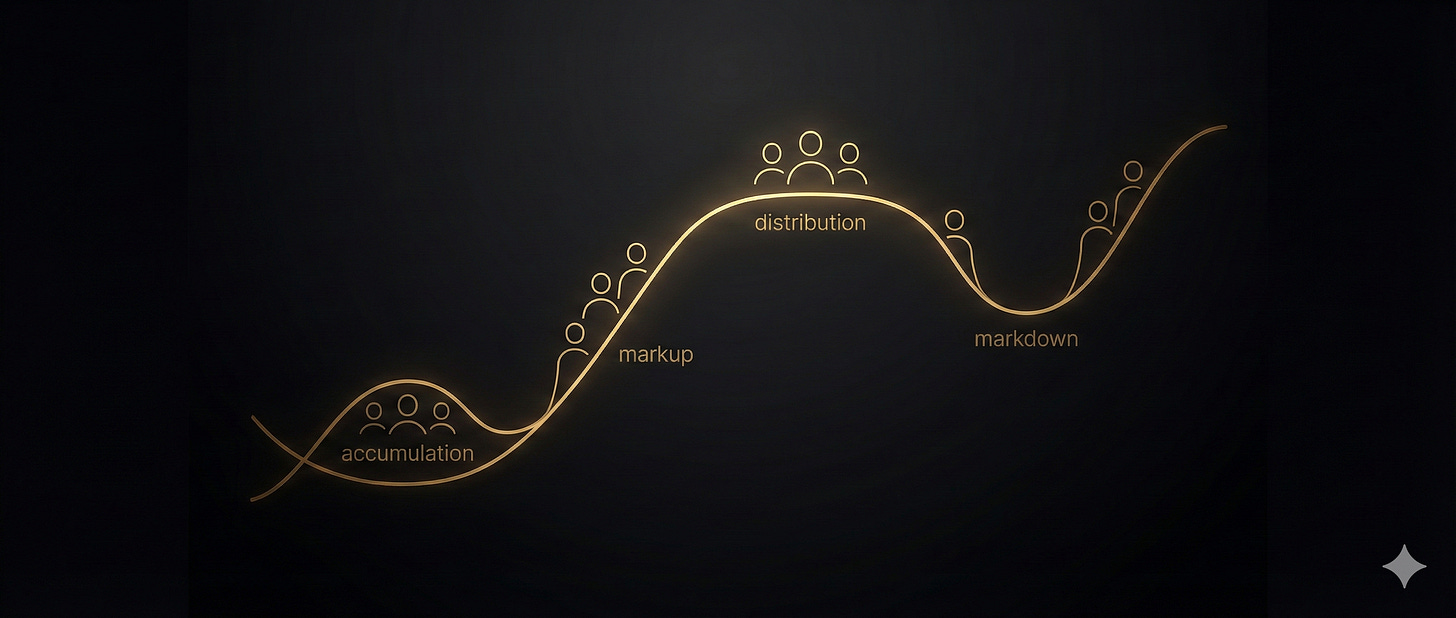

The Four Phases of a Market Cycle

Every enduring asset class experiences four repeating psychological and price phases:

Accumulation - quiet, forgotten, undervalued

Markup - recognition, momentum, rising adoption

Distribution - euphoria, complacency, peak optimism

Markdown - fear, panic, capitulation

These phases repeat not because markets are predictable -

but because people are predictable.

Let’s break them down.

1. Accumulation Phase

The quiet bottom

This follows the collapse of the previous cycle.

Prices are flat

Volatility is low

Sentiment is dead

Media has moved on

Retail is gone

Conviction investors accumulate deeply and quietly

This is where the next cycle begins - long before anyone realises.

2. Markup Phase

The long uptrend

The market begins to rise steadily.

Higher highs and higher lows

Increasing volume

Retail returns

Narratives strengthen

New money flows in

This is the phase where those who paid attention early begin to see the rewards of patience and conviction.

3. Distribution Phase

The euphoric peak

Eventually, the uptrend becomes overextended.

Everyone becomes bullish

Narratives become exaggerated

Smart money distributes slowly

Retail buys aggressively

Price volatility increases near the top

This is where emotion overtakes logic.

4. Markdown Phase

The painful decline

The cycle reverses.

Prices fall sharply

Narratives collapse

Participants deny the decline

Panic takes over

Leverage gets wiped out

The market eventually bottoms

And once again, the silence of accumulation begins.

Important Clarification #3: Markdown Does Not Mean Prices Must Go Below Previous Accumulation Levels

Many people assume:

“If the market is crashing, it must go lower than the previous bottom.”

That is only true for assets that:

do not grow over time,

do not attract new participants,

do not expand in utility or value,

do not have larger economic scale cycle after cycle.

In a growing asset class, the four phases still occur,

but the floors and ceilings shift upward over the long term.

This is the key distinction:

Within a cycle, prices can rise or fall dramatically.

Across cycles, prices still trend upward - slowly but surely.

This is why equity markets have higher bottoms every decade.

This is why Bitcoin’s “worst” crashes keep happening at prices that were once all-time highs.

This is why long-term zoom-out perspective matters more than anything else.

Cycles repeat.

Human behaviour repeats.

But the baseline keeps climbing.

Bringing It All Together

Most people only see what happened last week.

Cycles are understood only when you zoom out to the last 7 years, 10 years, 20 years.

If you don’t understand cycles:

every rally feels like a missed opportunity,

every crash feels like the end,

every decision feels emotional,

and every move feels reactive.

If you do understand cycles:

you stop chasing what’s already up,

you stop panicking when things fall,

you stop thinking in days or weeks,

and you start thinking in years and decades.

Because the market isn’t unpredictable.

It is simply reflecting the greatest repeated pattern in finance:

Human nature.

And once you understand that,

you’ll realise the market is not a mystery -

it’s a mirror.

Disclaimer

This is educational content, not financial, investment, tax, or legal advice.

Zenca shares perspectives and frameworks to help you think clearly - your decisions are your own.

Please think independently and do your own research.

Good Read 👍🏼